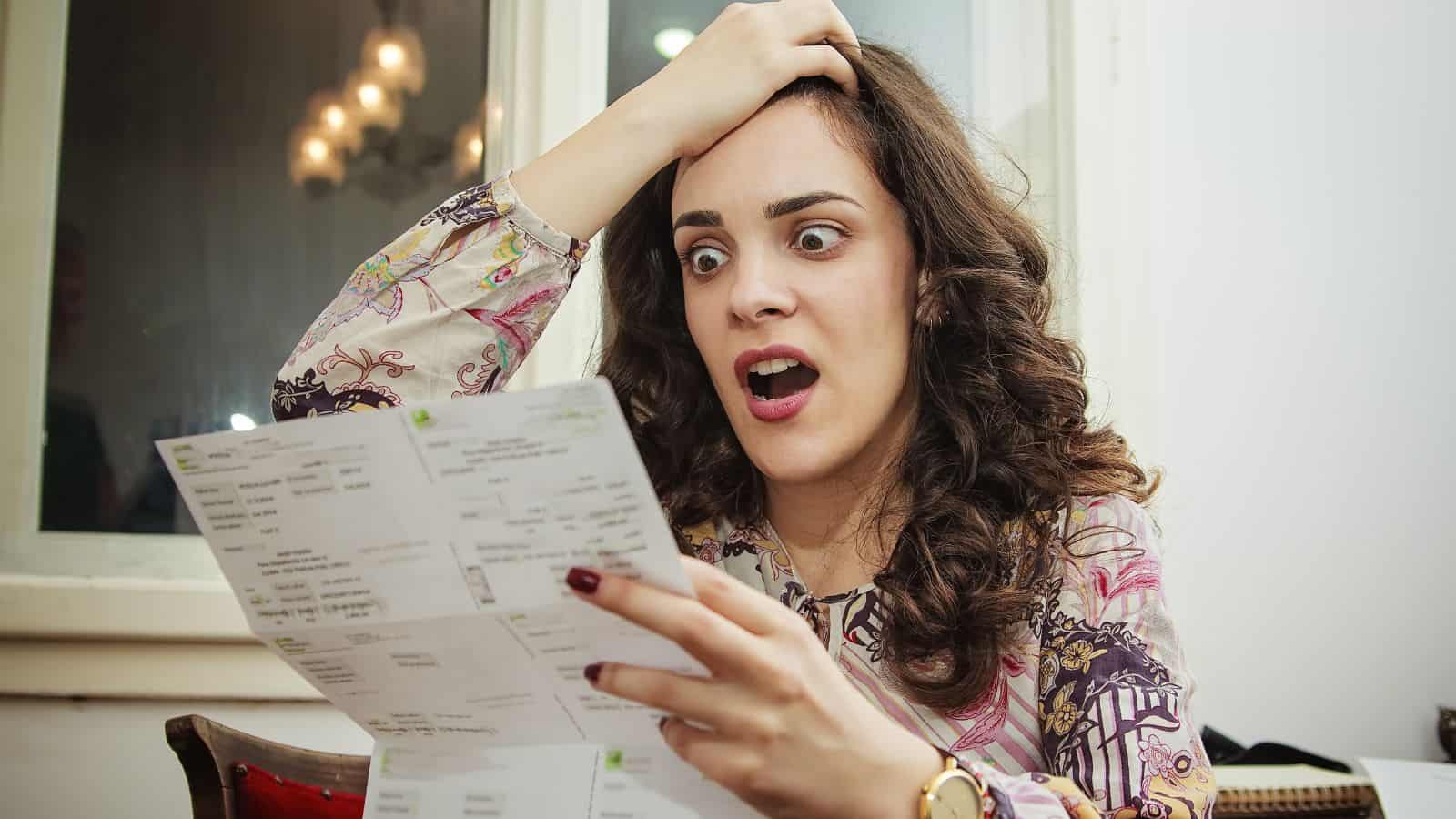

12 Stunning Methods You are Losing Cash Each Day With out Realizing it

[ad_1]

You’re employed exhausting on your cash, so why senselessly throw it away? Listed below are 12 surprising methods it’s possible you’ll be losing cash with out even realizing it.

Procrastinating

It appears odd, however procrastination could cause you to waste cash. Have you ever ever waited to buy one thing you want, solely to see the value go up while you do finally make the acquisition? That’s wasted cash.

Research present the common grownup wastes $52 a day by procrastination. That’s simply over $2 an hour. It’s not vital, however it will possibly add up.

Consuming Out

Everybody loves a meal out. You keep away from spending time within the kitchen, and share time collectively over a pleasant meal. Sadly, that comes at a price.

The typical American family spends $300 a month eating out. It might be extra when you’ve got a bigger household. This could be a actual drag on a funds. You don’t must remove it solely. Reduce spending in half and also you immediately unencumber money.

Unused Subscriptions

Do you utilize each subscription you’re paying for? Maybe you’re not utilizing your Amazon Prime membership. That’s money you’re setting aflame.

Undergo your subscriptions recurrently and see which of them you don’t use. Cancel them and put that cash to higher use. An app like Rocket Cash can do the heavy lifting for you and streamline your spending.

Meals Waste

Reviews present 35 % of our meals provide leads to landfills. That quantities to just about $1,500 a yr per family, or $125 a month you’re actually throwing within the trash.

You may remove a lot of this by purposeful buying and consuming leftovers. Freezing some meals objects is one other method to lengthen their lifespan and reduce down on waste.

Paying for Cable

Cable subscriptions are one of many greatest cash wasters there are. When you’re paying the common month-to-month invoice of $200+ a month, you’re losing cash.

It’s simpler than ever to reduce the twine on cable TV and save no less than $100 a month. Streaming providers haven’t any contracts, and you may get the identical dwell sports activities and common TV reveals for a fraction of the fee.

Shopping for Espresso On a regular basis

Saying to cease shopping for espresso on the go is a simple goal. Nonetheless, when you’re shopping for espresso on a regular basis you’re simply spending $20-$30 every week.

Keurig machines vary from $70 to $170 on Amazon. You would have a brand new machine in lower than two months and scale back your spending. Win-win.

Not Taking Benefit of 401K Matches

Saving for retirement is important. Nonetheless, one in 4 American staff don’t reap the benefits of 401(ok) matches obtainable by their employers.

Whereas it could be difficult, at instances, to save lots of, free cash is free cash.

Not Utilizing Reusable Water Bottles

There’s nothing just like the style of contemporary, filtered water. However, you don’t want industrial bottled water to get that. The typical American household spends over $1,300 yearly on bottled water.

You may get the identical factor with a reusable water bottle and a Brita filter or an under-the-sink water filter. We now have a Brita filter and it really works nice.

Paying Financial institution Charges

Why do you have to pay a financial institution to carry your cash, after they’re lending it out to earn curiosity? Sadly, too many banks nonetheless cost month-to-month upkeep charges.

Reviews point out the common American pays $15 a month in banking charges every month. That will not appear to be lots, however when you don’t have lots in your account it actually eats at it. Discover a financial institution that doesn’t cost upkeep charges and have extra of your cash give you the results you want.

Having an Costly Telephone Plan

Like cable, you not have to pay by the nostril for an costly cellular phone contract. The typical American spends $115 a month for cellular phone service.

That’s losing cash. Due to pay as you go cellphone plans, you may get limitless information for as little as $30 a month, and no contract.

Paying Curiosity

Excessive-interest bank card debt could be suffocating. Curiosity is a key element of that. For instance, when you’ve got $25,000 in debt and are being charged 20 % in curiosity, that’s $5,000 in curiosity a yr.

It’s potential to repay debt. Create a plan, and work to knock it down.

Grocery Supply

Meal and grocery supply is handy, however you pay for profit. The typical American family spends over $650 a yr, simply on the charges for meals supply.

Benefiting from promotions, and decreasing the frequency of supply are the perfect methods to keep away from losing cash.

35 Confirmed Methods to Save Cash Each Month

Many individuals consider it’s unattainable to save cash. Or, they suppose saving $20 or $50 a month received’t quantity to a lot. Each are incorrect. There are a lot of easy money-saving ideas that may add as much as huge financial savings. You simply have to begin one, then one other, to extend your financial savings.

Methods to Save Cash Each Month

Learn how to Make Cash in One Hour

Whether or not you might want to make ends meet till payday otherwise you need additional spending cash, incomes fast money is feasible. Take a look at these legit methods to earn a living in a single hour.

Learn how to Make Cash in One Hour

15 Finest Options to Cable

You don’t essentially want dwell TV to exchange cable. Many streaming providers supply high quality content material and good options to slash your invoice.

Learn how to Watch ESPN With out Cable

Stay sports activities hold many individuals in a cable contract. There’s no want for that. Listed below are six methods to observe dwell sports activities on ESPN with out a nasty cable contract.

Learn how to Watch ESPN With out Cable

101 Methods to Make Cash on the Aspect

There are numerous aspect hustle concepts you may pursue. Not everybody will likely be a great match for you. Right here’s an exhaustive record of choices to make extra cash on the aspect.

Methods to Make Cash on the Aspect

Associated

[ad_2]