Inequalities, convergence, and continuity as “particular offers”

[ad_1]

The “epsilon-delta” nature of research will be daunting and unintuitive to college students, because the heavy reliance on inequalities somewhat than equalities. Nevertheless it occurred to me not too long ago that one may be capable of leverage the instinct one already has from “offers” – of the sort one usually sees marketed by companies – to get not less than some casual understanding of those ideas.

Take as an example the idea of an higher sure or a decrease sure

on some amount

. From an financial perspective, one may consider the higher sure as an assertion that

will be “purchased” for

items of forex, and the decrease sure can equally be considered as an assertion that

will be “offered” for

items of forex. Thus as an example, a system of inequalities and equations like

could possibly be considered as analogous to a forex fee alternate board, of the sort one sees as an example in airports:

Somebody with an eye fixed for recognizing “offers” may now understand that one can truly purchase for

items of forex somewhat than

, by buying one copy every of

and

for

items of forex, then promoting off

to get better

items of forex again. In additional conventional mathematical language, one can enhance the higher sure

to

by taking the suitable linear mixture of the inequalities

,

, and

. Extra usually, this mind-set is beneficial when confronted with a linear programming scenario (and naturally linear programming is a key basis for operations analysis), though this analogy begins to interrupt down when one desires to make use of inequalities in a extra non-linear style.

Asymptotic estimates resembling (additionally usually written

or

) will be considered as some form of liquid market wherein

can be utilized to buy

, although relying on market charges, one might have numerous items of

so as to purchase a single unit of

. An asymptotic estimate like

represents an financial scenario wherein

is a lot extra extremely desired than

that, if one is a affected person sufficient haggler, one can ultimately persuade somebody to surrender a unit of

for even only a tiny quantity of

.

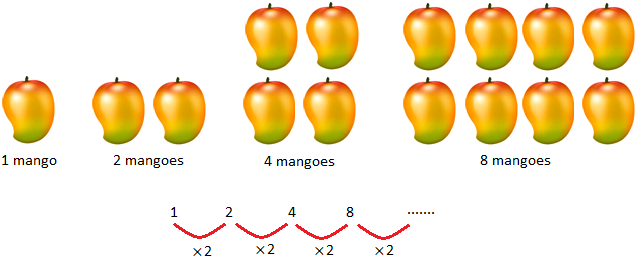

In relation to the fundamental evaluation ideas of convergence and continuity, one can equally view these ideas as numerous financial transactions involving the shopping for and promoting of accuracy. One may as an example think about the next hypothetical vary of merchandise wherein one would want to spend extra money to acquire greater accuracy to measure weight in grams:

The idea of convergence of a sequence

to a restrict

may then be considered as considerably analogous to a rewards program, of the sort supplied as an example by airways, wherein numerous tiers of perks are supplied when one hits a sure stage of “forex” (e.g., frequent flyer miles). As an illustration, the convergence of the sequence

to its restrict

gives the next accuracy “perks” relying on one’s stage

within the sequence:

With this conceptual mannequin, convergence implies that any standing stage of accuracy will be unlocked if one’s quantity of “factors earned” is excessive sufficient.

In the same vein, continuity turns into analogous to a conversion program, wherein accuracy advantages from one firm will be traded in for brand spanking new accuracy advantages in one other firm. As an illustration, the continuity of the operate on the level

will be considered by way of the next conversion chart:

Once more, the purpose is that one should buy any desired stage of accuracy of supplied one trades in a suitably excessive stage of accuracy of

.

At current, the above conversion chart is simply out there on the single location . The idea of uniform continuity can then be considered as an promoting copy that “supply costs are legitimate in all retailer areas”. In the same vein, the idea of equicontinuity for a category

of features is a assure that “supply applies to all features

within the class

, with none value discrimination. The mixed notion of uniform equicontinuity is then in fact the declare that the supply is legitimate in all areas and for all features.

In the same vein, differentiability will be considered as a deal wherein one can commerce in accuracy of the enter for about linear conduct of the output; to oversimplify barely, smoothness can equally be considered as a deal wherein one trades in accuracy of the enter for high-accuracy polynomial approximability of the output. Measurability of a set or operate will be considered as a deal wherein one trades in a stage of decision for an correct approximation of that set or operate on the given decision. And so forth.

Maybe readers can suggest another examples of mathematical ideas being re-interpreted as some form of financial transaction?

[ad_2]