The Tax Deduction Cheat Sheet for Freelancers & Self-employed

[ad_1]

This put up could comprise affiliate hyperlinks. See our affiliate disclosure for extra.

- There are a number of choices for a tax deduction that embrace your mortgage, web, and utilities

- Schooling bills corresponding to conferences, conferences, and Masterminds might be deducted out of your taxes

- All the time examine with IRS if there’s ever any unusual tax state of affairs to make sure you are okay to deduct

Have you ever ever filed your tax return solely to comprehend that you may’ve deducted a major enterprise expense? Hopefully, a tax deduction cheat sheet can be sure that you by no means miss out on one other deductible expense once more.

As a freelancer or self-employed sole dealer, you possibly can declare deductions on any enterprise buy that’s extraordinary and obligatory in your line of labor. So, every part from your own home utilities to your small business meals are classed as tax deductible.

However, like just about each tax-related exercise, there are lots of guidelines and much more confusion.

Overlook tax deadline stress—tax return stress is a really actual factor. Based on Credello, one-third of People are nervous that they failed to maximise their tax refund. And, 25% fear that they’re going to get audited by the IRS as a result of they’ve made a mistake.

So, we’ve created a tax deduction cheat sheet that can assist you maximize your tax refund or cut back your tax invoice. We’re additionally going to debate some greatest practices for submitting your tax return to hopefully ease a few of your tax deadline stress.

Tax deduction cheat sheet for freelancers and self-employed

What tax-deductible enterprise bills are you able to make the most of? Let’s check out among the principal bills you can deduct no matter your business.

Hire, mortgage, and utilities deduction

Should you make money working from home, you’ll be entitled to the house workplace house deduction no matter whether or not you personal or lease. That is most likely probably the most substantial tax deduction you possibly can declare, however it’s additionally probably the most advanced.

Put merely, the house workplace house you employ commonly and completely for enterprise operations is tax deductible. So if, for instance, your own home workplace amounted to twenty% of your total house, you possibly can deduct 20% of your lease as a tax-deductible expense.

The identical goes on your mortgage curiosity and utilities too. If 10% of your electrical energy invoice powers your own home workplace, then you possibly can deduct that portion. That is known as the common methodology for calculating house workplace house deductions.

After all, truly making these calculations is a reasonably intensive job. Speaking them in your tax varieties is much more so—it’s important to full kind 8829, which is a prolonged 43 traces. Because of this, IRS has devised a simplified methodology.

The simplified methodology deducts $5 for each sq. foot of your own home workplace house (as much as 300 sq. ft). Which means that house workplace deductions utilizing this methodology are capped at $1,500.

Regardless of the cap, many freelancers discover worth within the simplified methodology. There’s no want for kind 8829 (the worksheet for the simplified methodology is simply six traces), so it’s a critical time-saver. Moreover, you don’t must make a lot of particular person calculations on your completely different bills.

In case you have a small house workplace, you’re prone to see monetary advantages, too.

For these of you freelancing within the UK, house workplace tax deductions are even simpler. HMRC makes use of simplified flat-rate deductions based mostly on the variety of hours you’re employed in your house workplace per 30 days. Just like the US simplified methodology, this consists of utilities, insurance coverage, and so on.

Work-related schooling bills

The IRS acknowledges that steady coaching and schooling are crucial to freelancers. Since you don’t have an employer to cowl these prices for you, the IRS has made work-related schooling bills tax deductible.

So, what counts as a work-related schooling expense?

You’ll be able to deduct any convention you attend, course you enroll in, or textbook you purchase so long as it straight pertains to your present skilled occupation. They have to even be for the needs of sustaining and refining your skilled expertise.

So, for those who had been a contract graphic designer, you’d be capable of declare on design-related refresher programs however not on the meals diet course you accomplished for enjoyable—not even for those who had been planning on switching careers.

The identical guidelines apply to UK freelancers, too. HMRC means that you can deduct coaching programs which might be straight associated to your present space of enterprise. This implies you can’t write off a coaching course that helps you enterprise into a brand new space of enterprise, even when it pertains to your present enterprise.

Enterprise insurance coverage

Should you pay for insurance coverage to guard your small business, you possibly can deduct them as enterprise bills. For instance, you might need enterprise legal responsibility insurance coverage, particular occasions insurance coverage, or insurance coverage to guard your small business within the case of a hearth or pure catastrophe.

Everyone knows that it’s higher to be protected than sorry. However there’s no denying that insurance coverage premiums can put an enormous dent in your funds. Hopefully, having the ability to listing insurance coverage premiums as tax deductions can inspire you to bulk up your small business safety.

Bank card loans/curiosity

Any bank card loans you’ve taken out are tax deductible so long as the funds are used solely for enterprise functions. For loans that you simply use for enterprise and private purchases, the funds have to be distinguished accordingly. The identical goes for bank card curiosity, too.

Journey bills

Out of your aircraft fare and mileage to your lodge room and meals, you possibly can write off a good portion of your journey bills.

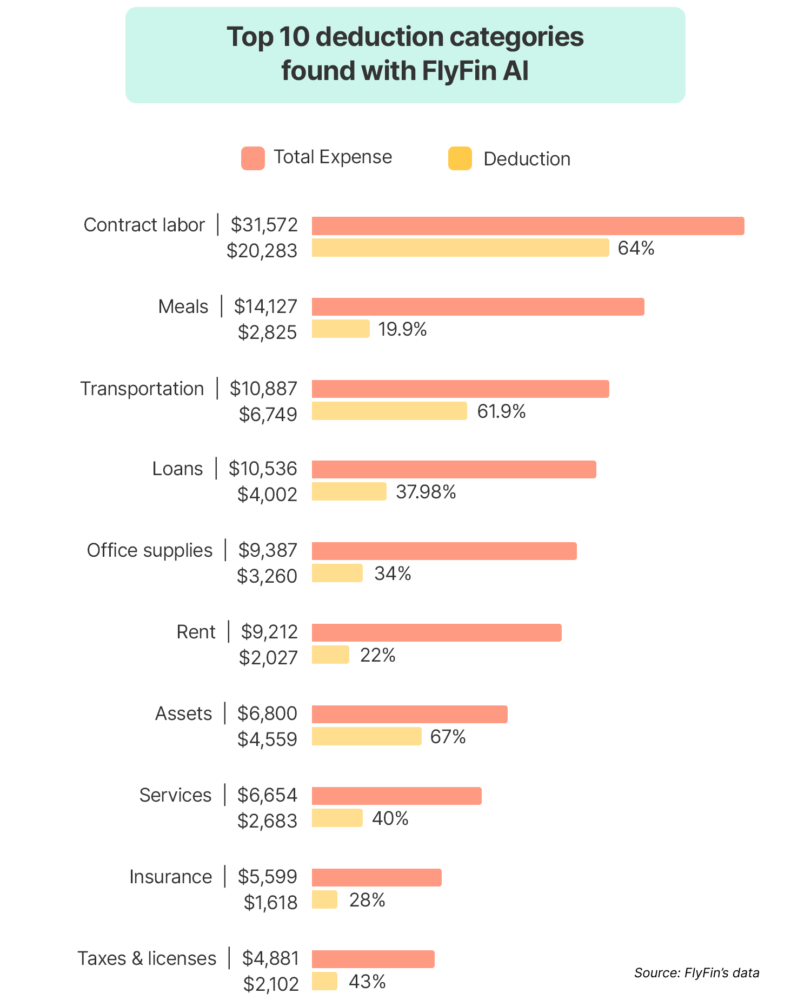

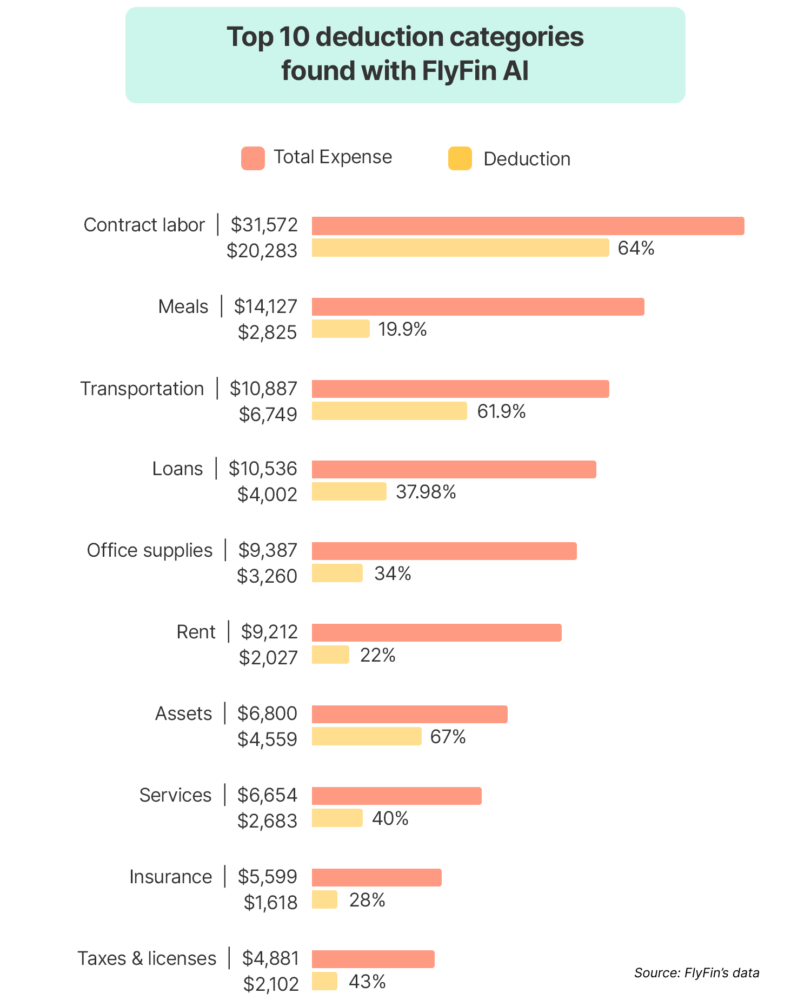

In truth—after contract labor—meals and transportation are the 2 mostly deducted enterprise bills, based on a latest evaluation by FlyFin.

With that being mentioned, the IRS is fairly strict about this class and there are lots of guidelines relating to enterprise journey bills.

For one, enterprise journey should be a sizeable distance from the common place of job and, of their phrases, “considerably longer than an extraordinary day’s work.” So, as a basic rule, you possibly can’t deduct the prices of day journeys or journeys inside your metropolis.

Moreover, the journey is simply classed as deductible if it’s made for enterprise functions (e.g. attending a convention or assembly a shopper). If you wish to take a mini-vacation when you’ve completed your small business actions, none of these prices are deductible.

As for the journey bills you can declare, among the principal ones embrace:

- Lengthy-distance transportation: Such because the aircraft, practice, and automobile bills used to achieve your small business vacation spot.

- Quick-distance transportation: For instance, the taxi or Uber between the airport and the lodge.

- Lodging: You’ll be able to deduct the price of your lodge keep, though it shouldn’t be unreasonably extravagant.

- Meals: That is for enterprise meals solely and, as soon as once more, can’t be unreasonably extravagant.

Within the US, issues like baggage delivery, dry cleansing, and even ideas are additionally classed as tax-deductible bills.

HMRC are equally as strict about enterprise journey and thus all the above guidelines apply. Together with all the principal journey bills we’ve talked about above, you possibly can declare tax reduction on issues like congestion fees, tolls, and parking charges.

Enterprise promoting

Many people pay for promoting in some kind, whether or not it’s on social media, Google, or in {a magazine}. It may be a expensive expenditure for freelancers who depend on steady paid promoting to draw new purchasers. Fortunately, it’s additionally a tax-deductible expense.

In addition to conventional and internet marketing, the IRS means that you can deduct the prices incurred from any enterprise playing cards or brand-focused merchandise you create. HMRC means that you can deduct free samples and web site prices.

Phone and web

You’ll be able to declare a share of your phone and web bills as tax-deductible bills. To work this out, you’ll must calculate how a lot of your web and phone utilization is credited to enterprise operations.

Should you use the identical telephone for enterprise and private communications, you’re going to have to select your telephone payments aside with a fine-tooth comb. By utilizing two separate telephones for enterprise and private use, you possibly can merely deduct 100% of your phone bills (and keep away from working into points with the IRS or HMRC).

Software program subscriptions

Relying in your business, you most likely depend on at the least one software program subscription. Whether or not it’s image-editing software program like Photoshop or word-processing software program like Microsoft Workplace, you possibly can deduct the price of all of the software program that your small business must thrive.

You’ll be able to even declare tax deductions on the web accounting software program you employ to handle your funds.

Whereas we’ve coated many of the principal tax deductible bills, you may also declare deductions on issues like workplace provides and gear, depreciation, and even contract labor. So, be sure to do your analysis to get probably the most out of your tax refund.

5 Ideas for submitting freelance taxes

It’s all nicely and good understanding which enterprise bills you possibly can deduct. However, for those who don’t have a streamlined tax administration and returns technique, it’s simple to run into issues along with your tax authority.

Bear in mind the Credello research we talked about earlier? Effectively, not solely are 25% involved about getting audited by the IRS, however 14% fear that they received’t get any cash by any means due to a mistake they’ve made on their tax return.

This, together with the widespread fear of lacking deadlines and misplacing paperwork, all make for a really traumatic tax return expertise.

Following some easy greatest practices could make submitting your freelance taxes a lot much less irritating. One of many first issues you need to do is think about using an accounting or tax return system.

Benefit from an accounting system

We get it—guide tax submitting might be so laborious that calculating your tax deductions may really feel like simply one other chore.

The answer? Accounting software program that automates a lot of the tax submitting course of for you.

Choosing software program that makes a speciality of managing self-employed taxes is a good suggestion. For instance, options corresponding to Moxie and Sage are designed to satisfy the distinctive wants of sole merchants. This software program can import all your transactions routinely, supplying you with real-time perception into your completely different revenue streams.

Accounting software program isn’t just for serving to you handle your cash as a freelancer. Together with storing and organizing your tax data, the very best accounting software program can acknowledge any tax deductions you’re entitled to and calculate them routinely. All you should do is enter your tax data into the system, and the software program will do the remaining.

In addition to being a time-saving shortcut, accounting software program minimizes the chance of human error.

Paper-based tax submitting practices are vulnerable to disorganization and miscalculations that may have important money and time repercussions. Accounting software program ensures that all your tax data is strictly organized and appropriately calculated. Should you do enter one thing incorrect, the very best accounting software program will flag it as a possible error.

Additionally, as a result of consumer-based accounting techniques are designed for non-tax professionals, they’re extremely user-friendly and extra reasonably priced than hiring an accountant. What’s extra, many suppliers supply round the clock buyer help from licensed public accountants (CPAs).

For these self-employed within the UK, take word that you simply received’t be capable of submit paper tax returns in any respect by April 2026. That is a part of HMRC’s MTD (Making Tax Digital) initiative. Accounting software program will aid you put together for tax digitization nicely upfront of the deadline, serving to you keep compliant and arranged.

Preserve an organized document of your revenue and bills

When you could have a number of aspect hustles, purchasers, and initiatives on the go, preserving observe of all of your revenue streams can rapidly turn out to be overwhelming. However, reasonably than rent an accountant (which might get actually costly), you need to use a web-based spreadsheet or, even higher, accounting or tax return software program.

Accounting and tax return software program routinely information and organizes your freelance earnings and enterprise bills. They remove the various inefficiencies of paper-based tax submitting. And, not like spreadsheets, they make the most of automation which streamlines your total record-management course of.

Kind out tax-deductible expenditures

Utilizing the tax deduction cheat sheet as a information, you need to kind out your tax-deductible expenditures nicely earlier than the due date. This includes itemizing, categorizing, and repeatedly updating all related data, so it’s able to submit in your tax date.

Now, the place this will typically get tough for freelancers is in relation to distinguishing enterprise and private bills. As a strict rule, you possibly can solely declare on enterprise bills. Nonetheless, grey areas come up when an merchandise is used for each enterprise and private use (e.g., a cell phone that you simply use for enterprise and private communications).

To keep away from working into points along with your tax authority, think about using separate objects for enterprise and private use. If that’s not attainable, be sure that to appropriately distinguish the portion allotted to enterprise use. So, for those who bought a cell phone that you simply use for enterprise 60% of the time, solely 60% of that price can be tax-deductible.

To make issues even simpler, take into account opening a separate checking account on your self-employed enterprise.

Preserve a calendar of tax due dates and file early

Based on the IRS, freelancers who anticipate to owe greater than $1,000 on their subsequent tax return are required to make quarterly estimated tax funds. You must nonetheless file revenue tax returns yearly on or earlier than April 15

Should you fail to satisfy quarterly repayments, you’ll incur important penalties and cut back the advantages of tax-deductible bills.

Should you’re within the UK, the self-assessment tax deadline is January 31 for on-line submissions. The deadline for paper tax returns is a couple of months earlier. Nonetheless, understand that you received’t be capable of file paper tax returns by April 2026. You’ll find out extra about UK tax deadlines on the GOV UK web site.

So, when you’ve collected your tax dates, add them to a web-based calendar or, even higher, your accounting software program to get routinely notified of upcoming dates. Utilizing accounting software program to file your tax returns early has a number of advantages.

For instance, it could possibly:

- Aid you keep away from processing delays: Early filers and digital filers are much less affected by holdups.

- Provide you with extra time to organize for tax payments: Understanding how a lot your invoice can be forward of time helps you price range accordingly and reduces monetary pressure.

- Eradicate a few of your tax deadline stress: While you’re not speeding to satisfy deadlines, all the tax return course of turns into a lot much less traumatic.

Preserve a digital document of invoices, receipts, or ledgers

Digital record-keeping is far more handy than the paper different. Digital invoices, receipts, and ledgers might be saved and arranged for straightforward accessibility and compliance. You’ll be able to even digitize your paper paperwork by scanning them with a scanner or cellular scanner app.

There are a couple of greatest practices you need to comply with to enhance the effectivity of your digital record-keeping. A very powerful factor you should do is again up your paperwork in a couple of place.

So, don’t simply save all your paperwork in your accounting system and be accomplished with it. Save them in your Google Drive, Dropbox, or native onerous drive, too.

One other greatest observe is to make sure that your paperwork are organized. Title your paperwork appropriately (ideally a reputation that describes the file’s context), and maintain all of your associated information collectively. When you’re at it, think about using OCR (optical character recognition) software program to make your scanned paperwork searchable.

By implementing these greatest practices, you enhance effectivity and remove the wrestle that comes with sifting via mountains of paper. Plus, in case your information are saved, organized, and backed up on-line, all of your revenue and bills can be accounted for ought to the IRS must do an audit.

Conclusion

Submitting your taxes as a freelancer doesn’t should fill you with dread. By referring to this helpful tax deduction cheat sheet and adopting the very best practices talked about above, you may make your tax return course of as stress-free as attainable whereas having fun with higher tax returns.

And keep in mind, the enterprise bills listed on this tax deduction cheat sheet aren’t the one ones that may be accessible to you.

Take an excellent take a look at any enterprise expense you make and ask your self whether or not it’s extraordinary and obligatory on your business. Should you’re not sure, seek the advice of a CPA earlier than submitting it as a tax deduction.

Preserve the dialog going…

Over 10,000 of us are having every day conversations over in our free Fb group and we might like to see you there. Be part of us!

[ad_2]