Which is Higher in 2023?

[ad_1]

This put up might include affiliate hyperlinks. See our affiliate disclosure for extra.

When you’re having hassle deciding on FreshBooks vs QuickBooks, this in-depth information is for you. We’ll discover the pricing, options, and different elements you’ll need to think about when debating between FreshBooks and QuickBooks: two of one of the best invoicing and bookkeeping instruments round.

Each are incredible accounting instruments—with in-built freelancer invoicing options, time monitoring instruments, and different useful assets and taking the time to check these two side-by-side will likely be time well-spent.

Comparability Abstract + Quick Solutions

When you’re in a rush and wish a fast reply, right here’s what we advocate:

- When you freelance or present a service and have aspirations to develop, go along with FreshBooks.

- When you don’t plan to rent or develop, use QuickBooks Self-Employed.

- When you’re a rising firm and wish a number of superior options, go along with QuickBooks.

For a deeper dive we’ve damaged our evaluate down into a number of important classes with which we’ll evaluate FreshBooks vs QuickBooks side-by aspect. Right here’s what you may anticipate:

How We In contrast Every Software program

There are a number of important items of data you’ll want when evaluating. Under are the classes we’ve recognized as important to realizing earlier than you select.

Pricing — Cash isn’t all the pieces when making a choice. Nevertheless it’s actually a important issue.

Fundamental Options — We’ll reply the query: which device can do extra of the duties you want accomplished frequently?

Premium Options — We’ll additionally establish which premium or unique options stand out in both accounting device

Flexibility — We’ll consider which software program permits for extra flexibility—an necessary ingredient if your online business remains to be rising and altering.

Connectivity — We’ll discover which device higher connects to different apps you employ every day to run your online business.

Monetary Assist — We’ll examine which device supplies extra monetary assist when it comes to accounting strategies and finest practices.

Technical Assist – We’ll establish which assist plan will likely be finest outfitted that can assist you remedy issues once they come up.

The Human Ingredient — We’ve additionally requested our group of freelancers and small enterprise homeowners to share their experiences utilizing FreshBooks or QuickBooks, and we’ll you should definitely embrace that information too.

What you need to personally think about

Whereas the weather of our comparability analysis offers you an goal look, it’s necessary to make sure you’re choosing your accounting software program based mostly by yourself particular person circumstances.

For instance, should you’re a freelancer on the lookout for a easy accounting device with room to develop, then you need to in all probability go along with FreshBooks.

Nonetheless, if in case you have no real interest in rising past your self OR you’re a much bigger well-established firm, then QuickBooks might be the higher alternative for you.

FreshBooks vs QuickBooks Pricing & Plans

The primary ingredient we’ll discover in depth is pricing. Whereas cash isn’t at all times absolutely the prime issue when selecting an account device or different software program, it needs to be on the prime of your checklist.

Each FreshBooks and QuickBooks supply month-to-month plans that appear fairly reasonably priced for any small enterprise.

Overview

Right here’s a fast overview of FreshBooks pricing vs QuickBooks On-line pricing at a look. For extra element, learn under this chart:

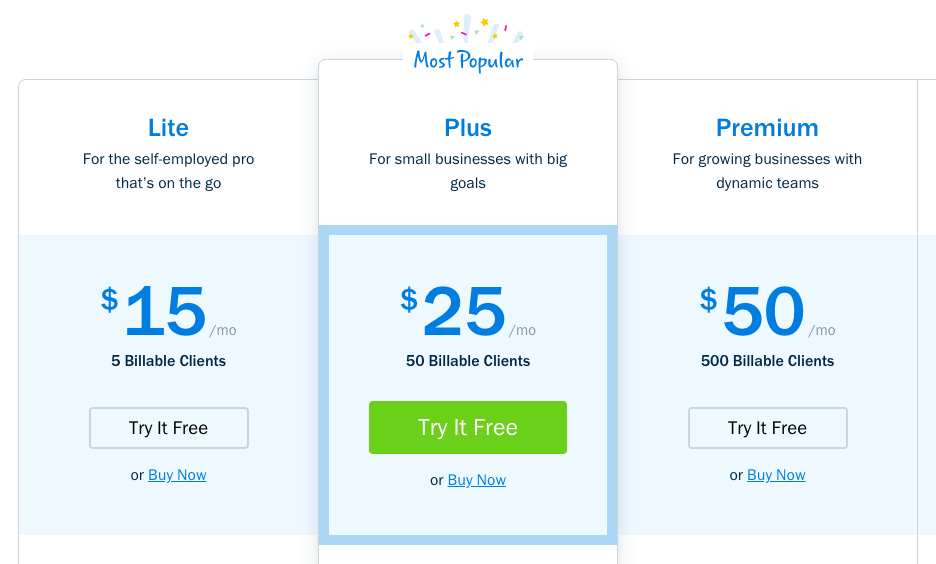

FreshBooks Pricing

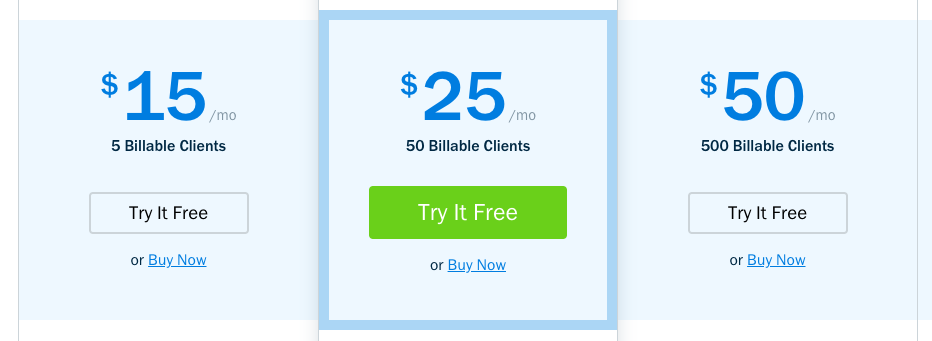

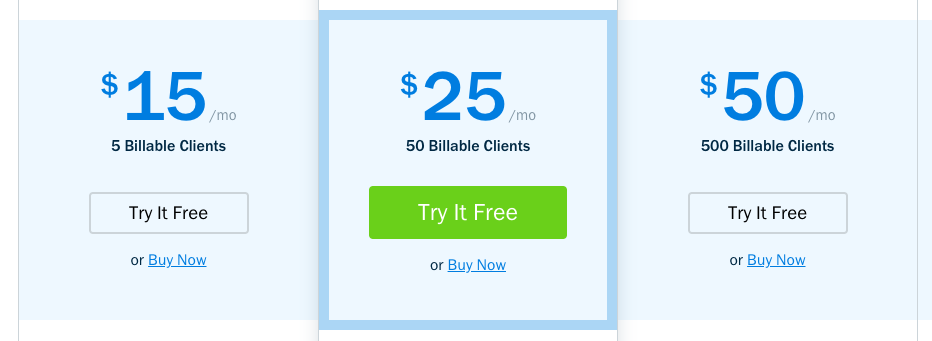

FreshBooks’ pricing choices are quite simple. They begin at simply $15/mo for freelancers and self-employed professionals and go to $50+ a month for bigger corporations with rising groups.

When you common out the price of every of their plans and divide by the variety of plans obtainable, you’ll see that on common you may anticipate to pay round $30/mo.

In all instances, you pay FreshBooks on a month-to-month foundation to make use of their service.

The “Plus” plan marked “hottest” is $25/month and is labeled as the fitting alternative “For small companies with huge targets.”

You don’t want a bank card to attempt FreshBooks. Simply select the plan that’s finest for you and you’ll attempt it fully free for 30 days.

As a bonus (QuickBooks On-line doesn’t supply this) you may join a full yr and save a bunch extra. You can too make this improve at any time throughout your keep as a buyer. You can find yourself paying as little as $13.50/mo for his or her “Lite” plan if it really works for you.

» Be taught extra about FreshBooks’ pricing right here

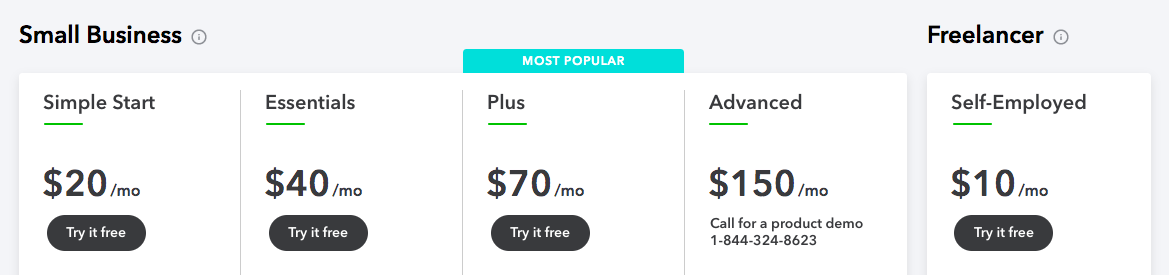

QuickBooks Pricing

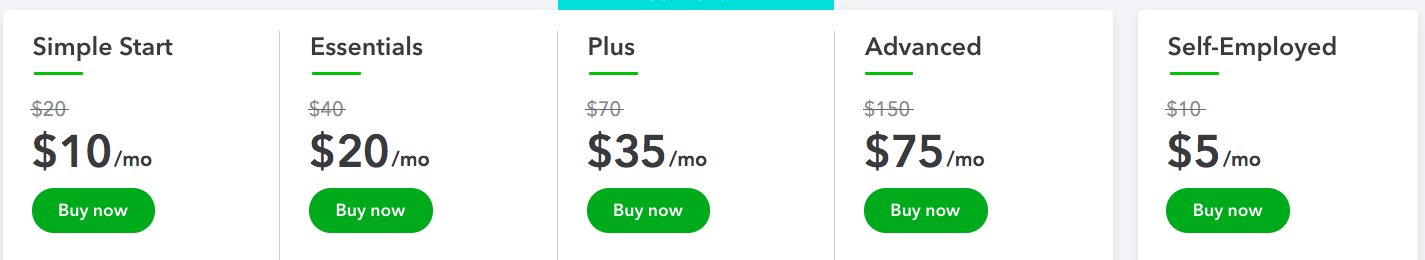

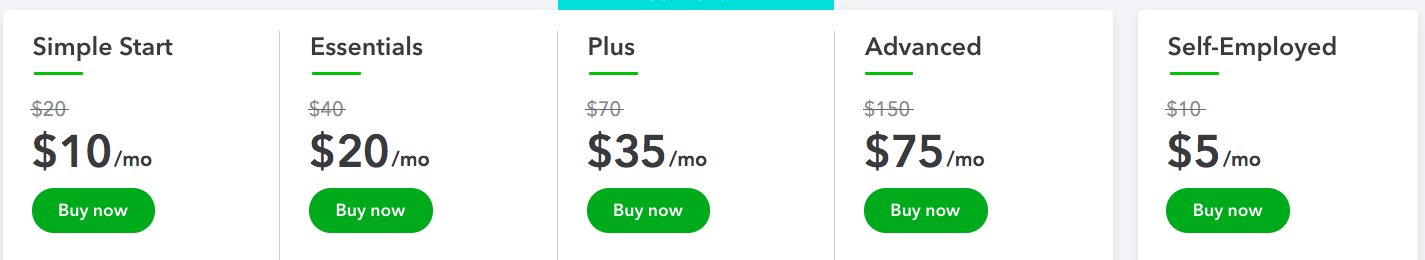

QuickBooks’ pricing choices are additionally very simple, albeit a bit costlier than FreshBooks.

At first look, they appeared to compete properly on worth—that’s till you understand you’re signing up for 50% off which solely applies to the primary 3 months of your account.

After the three month promotional supply is over, you’ll find yourself paying way more for QuickBooks then you’ll for FreshBooks. However bear in mind: we’ll evaluate options later. It’s attainable QuickBooks has some additional options you’ll need or want in a while.

When you common out the QuickBooks costs, you’ll land at about $58/mo.

QuickBooks additionally marks their “Plus” plan as their hottest possibility, and can price you $70/mo (after the promo) to remain on as a buyer.

And should you select the 30-day trial, you don’t must enter your bank card till you’ve tried QuickBooks for your self.

» Be taught extra about QuickBooks’ pricing right here

FreshBooks Plans

Now that we’ve obtained pricing out of the way in which, let’s speak about what every FreshBooks plan really presents you as a buyer.

FreshBooks Lite Plan

When you’re simply beginning out as a freelancer or a side-hustler, it’s possible you’ll need to check out their “Lite” plan.

The “Lite” plan has plenty of nice options in-built together with a number of limitless options like Limitless Invoices, Limitless Time Monitoring, or Limitless Estimates.

The place you’ll discover the “Lite” plan to dwell as much as its identify is on the subject of variety of billable purchasers. It’s solely 5.

So until you’re billing all 5 of your purchasers an unlimited charge each month, this will not be fairly sufficient for you.

When you’re unsure or solely have a pair purchasers, begin with “Lite” since you may at all times improve to the following degree if it is advisable to.

>FreshBooks Plus Plan

Shifting up the ladder to the “Plus” plan—which FreshBooks says is their hottest plan—you get some options that I personally actually love (lined extra within the function set part under) equivalent to computerized bill reminders, scheduled late charges, and the choice to set purchasers on freelance retainer.

When you’re beginning to really feel established as a freelancer or small enterprise, likelihood is you need to attempt the “Plus” plan. It’ll probably be one of the best match.

FreshBooks Premium Plan

Nonetheless, if your organization is rising shortly and it is advisable to spend money on a extra sturdy resolution, it’s possible you’ll need to check out FreshBooks’ “Premium” plan which is for rising companies with bigger groups.

This top-tier possibility will assist you to add workforce members and invoice as much as 500 purchasers each month. After all, should you’re fully killing it and billing greater than 500 purchasers a month, you may get a concierge resolution with their “Choose” plan.

After all, no matter what plan you begin with, you may at all times improve or downgrade as you want to match the wants of your organization.

» Be taught extra about every of FreshBooks’ plans right here

QuickBooks Plans

Like FreshBooks, QuickBooks has numerous plans tailor-made to suit the wants of your organization now—with the flexibility to regulate later as wanted.

QuickBooks Self-Employed Plan

For starters, their least expensive plan—labeled for Freelancers—is known as QuickBooks Self-Employed and begins at simply $10/mo (with 30-day free trial).

As a result of it’s QuickBooks’ most simple plan, it has a really restricted function set (nowhere close to FreshBooks’ entry-level possibility) and the kicker? It doesn’t improve to every other QuickBooks plan sooner or later.

We’ll attempt to not be offended that the plan labeled particularly for freelancers doesn’t present any room for progress. Thanks, QuickBooks. Hm.

When you plan to ever develop past simply your self, you’ll need to try QuickBooks’ “Small Enterprise” plans.

QuickBooks Easy Begin Plan

Their “Easy Begin” plan (the most affordable actual possibility) is $20/mo (after any promotions) and it’s the naked bones of what you would possibly want in your online business: expense monitoring, invoicing, accepting funds, and stuff like that. Important, however primary.

One notable perk that QuickBooks has over FreshBooks on this occasion is the flexibility so as to add 1099 contractors at this level.

Since your first rent will doubtless be a fellow contractor, this can be a actually nice function they’ve included of their newbie plan.

QuickBooks Necessities Plan

From there you may transfer up the ladder to the “Necessities” plan, including options like time-tracking and multi-user functionality.

However the reality is, you don’t actually get much more on your cash with the “Necessities” plan and it’s important to transfer one or two extra tiers as much as actually see a giant change in options.

QuickBooks Plus Plan

Marked as QuickBooks’ hottest plan, the “Plus” plan provides fairly a number of extra issues you can’t do in any of the earlier QuickBooks plans.

For starters, you may run extra superior studies and you’ll extra intently monitor the profitability of every challenge in your pipeline (as an alternative of the enterprise as an entire)—a much-needed possibility for service companies. With “Plus” you may as well add as much as 5 teammates which can turn out to be useful.

QuickBooks Superior Plan

If all of that also isn’t sufficient, you may improve to essentially the most premium possibility QuickBooks presents: their Superior Plan.

With “Superior” you’ll get all of the options of the opposite plans plus plenty of extremely customizable studies and talents for managing a large enterprise. You can too set person permissions (which may turn out to be useful when your workforce is rising) and also you’ll get additional particular customer support assist with their “Precedence Circle” buyer care.

With QuickBooks, you may improve or downgrade anytime so long as you don’t begin with the Quickbooks Self-Employed.

» Be taught extra about every of QuickBooks’ plans right here

The Winner of ‘Pricing & Plans’?

After cautious evaluate, we now have to say the winner of the plans battle is:

FreshBooks — Click on right here to attempt it free for 30 days

Why FreshBooks wins this battle

Whereas each rivals had some nice plans to supply at affordable costs, FreshBooks not solely presents a cheaper price common however appears to pack in simply as many important options into their starter plan…after which some.

QuickBooks’ short-sightedness in not letting freelancers improve from QuickBooks Self-employed to every other of their plans was additionally the nail within the coffin on this battle. Nonetheless a very good possibility, however FreshBooks pulled a transparent win out on this one in our opinion.

Fundamental Characteristic Comparability

The following huge query when deciding is: what primary options will I get as a brand new buyer?

To reply that, we’ll take a look at every of their entry-level plans and evaluate their function units to see precisely what you may anticipate as a naked minimal from every service.

Overview

Under is a fast look on the subject of primary options.

| Freshbooks Lite | Quickbooks SE | |

|---|---|---|

| Ship Invoices | Sure | Sure |

| Observe Bills | Sure | Sure |

| Settle for Playing cards | Sure | Sure |

| Settle for ACH | Sure | Sure |

| Observe Time | Sure | No |

| Ship Estimates | Sure | No |

| Get Assist w/ Taxes | Sure | Sure |

| Combine w/ Apps | Sure | Sure |

| Add Staff | Sure | No |

| Observe Receipts | Sure | Sure |

| Observe Mileage | No | Sure |

It’s necessary to notice that the 2 plans in contrast above are each the entry-level plans provided by each FreshBooks and QuickBooks however they’re not the identical worth.

FreshBooks’ begin plan (Lite) is $15/mo whereas QuickBooks’ plan (Self-Employed) is barely $10. So it’s solely pure it is perhaps lacking a number of options. That being stated, you’d need to improve by two tiers to get among the similar options in QuickBooks that you simply do in FreshBooks (extra on that later).

Invoicing

Invoicing is maybe some of the widespread and primary wants of your freelance enterprise. With out invoices, it’s going to be rather a lot more durable to receives a commission.

This implies, in our opinion, even essentially the most primary plans ought to embrace an honest invoicing functionality. And it seems they each do.

Invoicing with FreshBooks

With FreshBooks you may ship limitless invoices (to your group of 5 purchasers on essentially the most primary plan) and customise them to suit your firm’s model.

FreshBooks will even retailer and set up your invoices so that you by no means marvel which of them have been despatched, paid, or are overdue.

Be taught extra about FreshBooks Invoicing

Invoicing with QuickBooks

Utilizing QuickBooks, you may ship invoices after which monitor the standing of your invoices and ship reminders to purchasers who “neglect” to pay.

With QuickBooks, you may as well create partial invoices for milestones or partial funds, which is a pleasant function.

Be taught extra about QuickBooks Invoicing

Monitoring Bills

After all, some of the primary capabilities an account software program ought to do is aid you maintain monitor of the cash coming out and in of your online business.

Each FreshBooks and QuickBooks assist you to monitor primary bills of their entry-level plans.

Monitoring Bills with FreshBooks

FreshBooks’ expense monitoring options are extraordinarily slick. Maybe the best function is the flexibility to attach your financial institution on to FreshBooks so that every time an expense is comprised of your account, you see it (and might categorize it) in FreshBooks.

Be taught extra about Monitoring Bills with FreshBooks

Monitoring Bills with QuickBooks

With QuickBooks you may as well import knowledge out of your financial institution (or PayPal) and the QuickBooks software program will mechanically use the names and quantities to make an informed guess on what the expense needs to be categorized below for tax functions. Fairly cool.

Be taught extra about Monitoring Bills with QuickBooks

Accepting Funds

Sending invoices and monitoring bills is ok and good, however should you don’t really carry cash into your online business, then what’s the purpose of all of this?

That’s why any accounting software program value its salt ought to supply a top quality manner of accepting funds from purchasers when you’ve despatched them an bill.

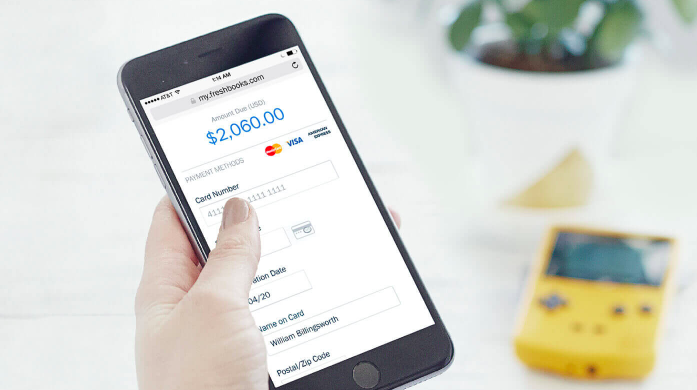

Accepting Funds with FreshBooks

With FreshBooks, your purchasers will pay their invoices instantly via the bill itself. No extra sending the bill with a PayPal hyperlink the place they’ll make a deposit or ready for a test within the mail.

Be taught extra about accepting funds with FreshBooks »

Accepting Funds with QuickBooks

QuickBooks additionally permits you to settle for Credit score Card and ACH funds instantly out of your bill. Their free (with sure plans) bank card reader additionally means you may settle for funds out of your purchasers in individual.

Be taught extra about accepting funds with QuickBooks »

Time-Monitoring

For a lot of small companies who cost by the hour for the work they supply their purchasers, a simple-yet-effective time-tracking app is a should.

And whilst you may select a time-tracking app that lives outdoors your accounting software program, each softwares supply time-tracking capabilities of their primary plans.

Time-tracking with FreshBooks

Even should you don’t cost by the hour, there are many good causes to trace the period of time you or your workforce are spending on every challenge.

And with the FreshBooks time-tracking device, you are able to do simply that. It’ll type time by challenge or by class, providing you with an ideal image of the place you’re spending your valuable time every day.

Be taught extra about time-tracking with FreshBooks

Time-tracking with QuickBooks

Sadly, that is the place we begin to see a small divide between on FreshBooks vs QuickBooks when it comes to what QuickBooks presents of their starter plan (Self Employed) and what FreshBooks presents in theirs (Lite).

QuickBooks doesn’t introduce time-tracking till their “Necessities” plan which is $40—a whopping $25/mo greater than FreshBooks’ most simple possibility.

For that form of cash, you might get a distinct time-tracker (I like this one), however it wouldn’t combine along with your accounting software program. Bummer.

Sending Estimates with FreshBooks vs QuickBooks

There’ll probably be moments in your online business while you aren’t fairly able to ship an bill (perhaps the consumer hasn’t finalized their determination) however it is advisable to maintain the challenge shifting ahead.

That is the place estimates are available in. Sending an estimate makes it simple on your buyer or consumer to get a transparent image of what they’re moving into and the way a lot it is going to price them. It additionally helps you get an image of what to anticipate when it comes to income if this consumer finally ends up hiring you.

Sending estimates with FreshBooks

With FreshBooks’ most simple plan, you may ship limitless estimates to potential new purchasers.

FreshBooks will even maintain notes and monitor necessary occasions associated to your estimate—together with the consumer’s approval particulars—which implies you don’t need to dig via your electronic mail to seek out all of this necessary information.

As soon as an estimate is accepted, you may convert that estimate into an bill, which is a very cool function to streamline your course of and get you paid a bit sooner.

Be taught extra about sending estimates with FreshBooks

Sending estimates with QuickBooks

Sadly, QuickBooks’ most simple plan (Self Employed) doesn’t supply any type of estimating device for sending proposals or estimates of any sort—which, truthfully, feels unusual for a plan really useful for freelancers.

With the intention to ship estimates, you’ll must improve to QuickBooks’ “Easy Begin” plan which is able to run you $20/mo—giving FreshBooks a leg up on this FreshBooks vs QuickBooks comparability.

To see what we imply, evaluate QuickBooks plans right here.

Getting Tax Assist

Monitoring bills and sending invoices is nice, however when it comes time for taxes, the entire paperwork (from receipts in a shoebox to digital invoices) can really feel overwhelming should you don’t know what you’re doing.

That’s why we have been completely satisfied to see that FreshBooks’ vs QuickBooks’ most simple plans are fairly equal when providing at the very least some type of tax assist. Every firm takes a novel strategy to tax assistance on their entry-level plans, so let’s dig in to see what each presents.

Getting tax assist from FreshBooks

Along with having a big library of tax apps that can combine with Freshbooks so as to provide you with a extra full image of your tax obligation annually, you may as well run tax-specific studies at tax time which you’ll then give to your accountant or enter in your accounting software program.

Getting tax assist from QuickBooks

As a result of QuickBooks is a product of Intuit—which makes a speciality of tax software program—it far surpasses FreshBooks on this regard.

Not solely will it additionally run studies like FreshBooks does, QuickBooks’ most simple plan will allow you to estimate your quarterly tax obligation (earlier than it’s due) and you’ll set up revenue & bills for immediate tax submitting when the time comes.

When you plan to do taxes your self (as an alternative of hiring an accountant or utilizing a service like Bench), it’s possible you’ll need to go along with the QuickBooks plan.

Be taught extra about how Quickbooks may help you with taxes

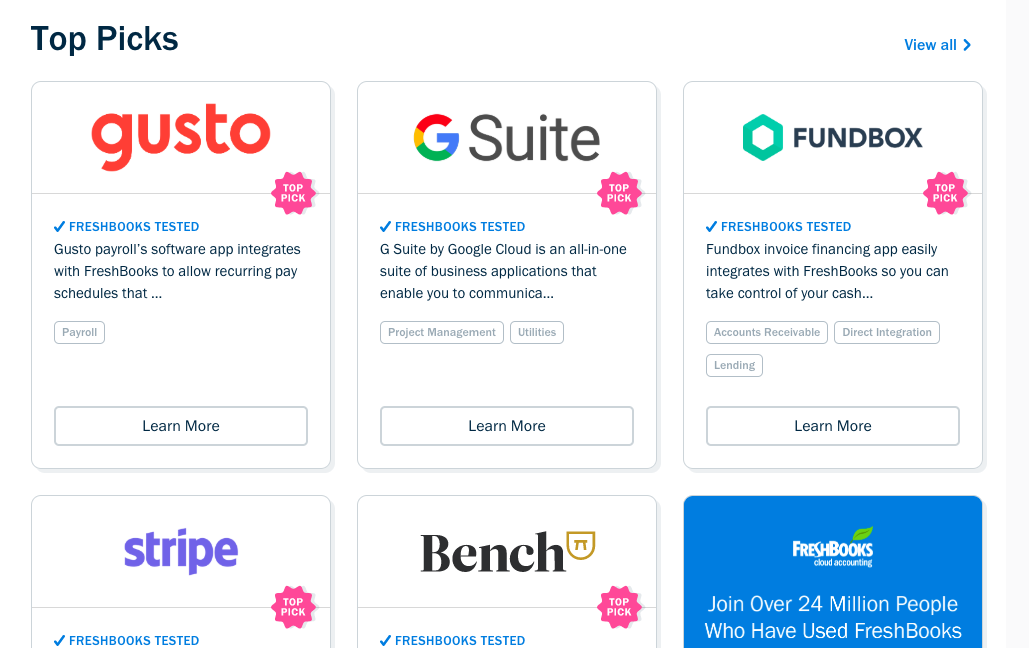

Integrating with Third-Get together Apps

As a freelancer or small enterprise service supplier you in all probability put on a zillion hats. And bookkeeping, accounting, funds, and many others. are simply one of many many issues that maintain your online business shifting ahead.

That’s why it’s necessary that your accounting software program can talk the place wanted with different instruments you employ every day to get your work accomplished.

Third Get together App Integration with FreshBooks

As a result of FreshBooks is very centered on service corporations, they’ve plenty of nice apps of their integration library to assist transfer your online business ahead.

And the vary is fairly broad; from group instruments like G Suite to communication instruments like Slack to payroll software program like Gusto.

See FresBbooks’ App Integration Library

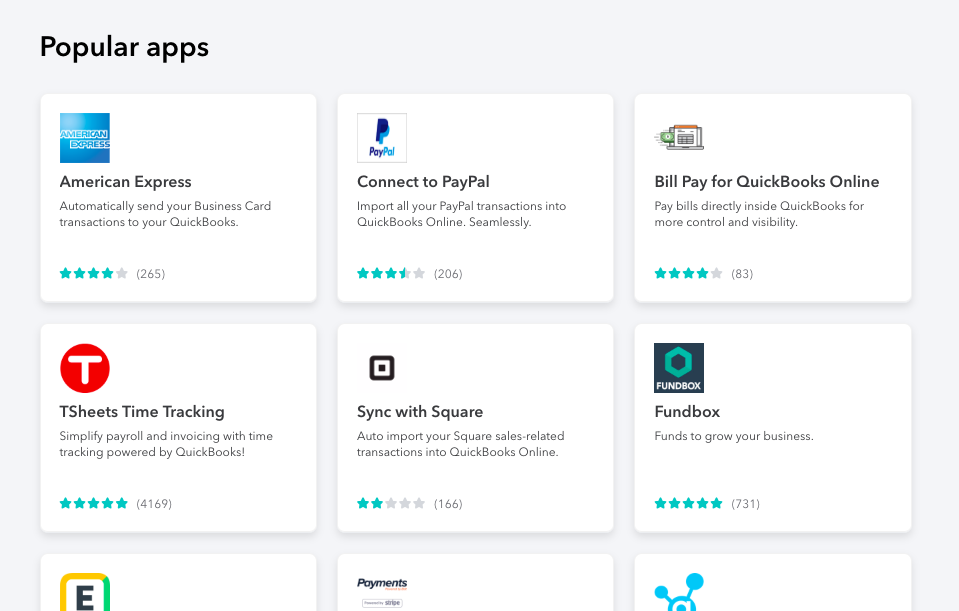

Third Get together App Integration with QuickBooks

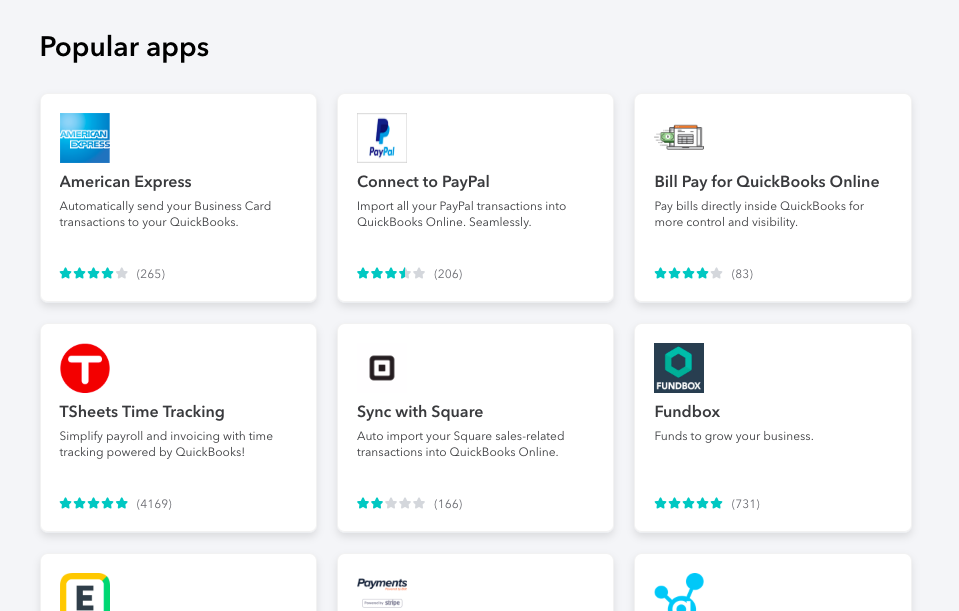

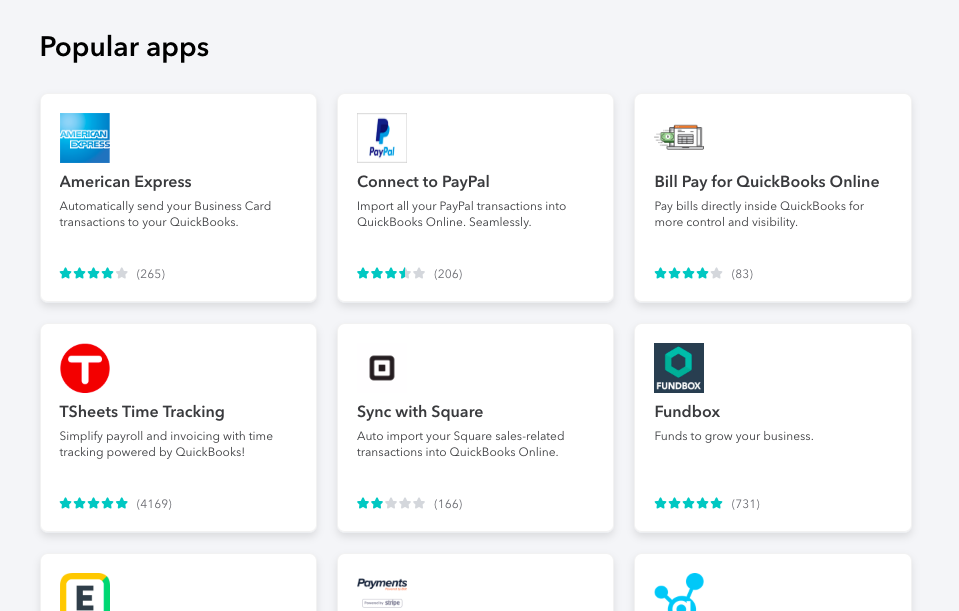

Equally, QuickBooks has a sturdy library of third-party apps that can assist you run your online business extra easily.

QuickBooks focuses on bigger (or aspiring to be bigger) corporations by integrating with fund-raising software program like Fundera, human useful resource apps like HRweb, or stock administration apps like Webgility.

When you’re ramping as much as construct a much bigger enterprise, this app library could also be extra your match.

See QuickBooks’ App Integration Library

Including Teammates

When you could also be a single-person enterprise, freelancer, or sole proprietor now, there might come a day while you need to scale your online business to one thing a bit larger.

In that second, it’s possible you’ll need to share monetary knowledge and studies with members of your workforce so the monetary monitoring burden doesn’t fall fully in your shoulders.

Teammates who might have entry to your accounting software program embrace an accountant, a associate, a bookkeeper, and even only a trusted worker or assistant.

That is one ingredient the place evaluating FreshBooks vs QuickBooks actually took us abruptly. Up to now, FreshBooks has been tailor-made extra for groups of 1. And QuickBooks has been constructed extra for groups and rising corporations.

However team-adding skills appear backward. Right here’s why:

Including teammates with FreshBooks

With FreshBooks Lite, you may add new workforce members to your account for $10/mo per teammate.

It’s a little bit of a steep worth contemplating your entire plan is barely $15/mo however it’s possible you’ll discover it value it to dump among the burden of invoicing, monitoring funds, sending proposals, and many others.

Including teammates with QuickBooks

Neither of QuickBooks’ most simple plan (Self-Employed) or the following degree up (Easy Begin) assist you to add workforce members.

So as to add teammates utilizing QuickBooks, it’s important to improve two ranges to their $40/mo Necessities plan. Whereas QuickBooks limits teammates to a max of three at this degree, the mathematics really makes a bit extra sense if you realize you need to add your workforce instantly.

Right here’s the way it breaks out while you evaluate them:

| Freshbooks Lite | Quickbooks Necessities |

|---|---|

| Beginning worth: $15/mo | Beginning worth: $40/mo |

| 3 Teammates: $10 every (whole: $30/mo) | 3 Teammates: included in plan |

| Whole: $45/mo | Whole: $40/mo |

Take word: this math solely is sensible if you have already got 3 teammates who you’ll need to give entry to instantly.

Sadly, although, FreshBooks $10/mo/member price by no means goes away whereas QuickBooks means that you can add as much as 25 workforce members with their most costly ($75) plan.

The wanting it: if in case you have a big workforce and also you care rather a lot about sharing entry with them, go along with QuickBooks.

Monitoring Receipts

Relying on the form of enterprise you’re in, you may need plenty of receipts it’s important to maintain monitor of.

When you’re primarily a digital-service-based enterprise, this will not be the case because you don’t typically purchase bodily items that should be tracked.

However should you present a bodily service to your clients, it’s doubtless you’re ceaselessly shopping for a brand new half, a brand new device, or one thing else from a neighborhood retailer.

If that’s the case, you’ll desire a good (simple) technique to monitor your bills.

With each FreshBooks and QuickBooks, you may take photographs of your receipts along with your smartphone and assign them to particular bills pulled in out of your checking account. It retains all the pieces organized properly for later use.

Monitoring Mileage

Commuting to a co-working tempo, driving to a consumer assembly, or becoming a member of your buyer on-site to supply your service—all of those, and extra, are mileage bills which could be deducted out of your tax obligation. Meaning, you’ll need to monitor your mileage intently.

Monitoring Mileage with FreshBooks

Sadly, none of Freshbooks’ plans supply mileage monitoring built-in to the app itself. Whereas it does have a number of third-party integration choices for connecting your mileage app to Freshbooks, having it proper within the app itself could be good.

Monitoring Mileage with QuickBooks

Right here, QuickBooks outshines FreshBooks. Constructed instantly within the app itself and obtainable even in QuickBooks’ most simple plans, you’ll discover a easy, principally automated mileage tracker.

With QuickBooks Self-Employed (or actually any plan), you’ll have the flexibility to mechanically monitor miles along with your smartphone (no extra preserving a pocket book in your automobile). From there, you may separate enterprise journeys from private journeys and even add mileage manually should you didn’t have your telephone with you.

Be taught extra about QuickBooks’ mileage monitoring options

The Winner of ‘Fundamental Options’

The winner of this battle was not simple to decide on. In actual fact, we nearly known as it a tie.

However then we remembered one important ingredient that we had ignored on this evaluate: When you go along with QuickBooks’ most simple plan, you’re caught with it. You’ll be able to’t improve. It appears ridiculous, however it’s true.

So regardless that QuickBooks On-line has some good added options and makes extra sense should you’re already a longtime workforce, we needed to remember the fact that this battle was about primary options.

When you’re simply beginning out—and simply evaluating essentially the most primary of plans—then the higher alternative is:

FreshBooks’ Lite Plan — Click on right here to attempt it free for 30 days

Why FreshBooks wins this battle

The first factor to remember right here is that we’re evaluating primary options.

Which means, should you’re evaluating FreshBooks vs QuickBooks as a reasonably new freelancer or solopreneur, that is the fitting possibility for you.

FreshBooks Lite has all the fitting options so that you can get began on the fitting foot and, maybe extra importantly, provides you the choice to improve in a while as your online business grows.

If your online business has already grown, you’ll discover the following part on FreshBooks vs QuickBooks premium options useful.

Premium Options

In case your aim is to develop (it’s okay to remain small) and also you do issues proper, you’ll finally end up with a enterprise that’s larger than simply your self.

That’s nice information. And it will probably additionally add a little bit of pressure to organizing your funds, monitoring paperwork like proposals or invoices, and sustaining correct team-wide communication at your organization.

So for this subsequent part we’ll concentrate on the options you would possibly want as your change into extra superior in your small enterprise.

We’ll ask questions like: which might be higher for a small company? Or for a distant workforce of 5+ folks? Are there sufficient options on each platforms to permit for the proper of progress on the proper worth? And so forth.

We’ve taken a number of of our favourite premium options from every platform and in contrast how each measures up on every rely.

Overview

Under is a fast look at extra superior premium options.

| Freshbooks | Quickbooks | |

|---|---|---|

| Shopper Retainers | Sure | Sure |

| Scheduled Late Charges | Sure | No |

| Recurring Invoices | Sure | Sure |

| Observe Challenge Profitability | No | Sure |

| Stock Administration | No | Sure |

| Handle Sub-contractors | Sure | Sure |

| Handle & Pay Payments | No | Sure |

As with the “Fundamental Options” part above, we aren’t essentially evaluating apples to apples right here. Which means, we’re not evaluating solely the preferred plans, for instance.

As an alternative, we’re taking a extra macro-level view and easily asking: of the premium options that exist (options not included in essentially the most primary plan) which ones are value noting and the way does the competitors measure up?

It will not be sensible to make your remaining determination based mostly on this part alone.

Shopper Retainers

When you’re in your technique to turning into a bit extra superior than a one-person enterprise with a handful of recent purchasers every month, you’ve in all probability thought of consumer retainers as an possibility.

Shopper retainers are basically an agreed-upon quantity of labor (and subsequently income) your consumer is keen to pay you for every month. As you full work for that consumer, they could as much as the cap of the retainer (or extra in the event that they require extra work).

Shopper retainers could be a good technique to plan extra long-term relationships and income along with your purchasers.

Setting consumer retainers with FreshBooks

When utilizing FreshBooks, you may set consumer retainers as simply as you create an bill (which is fairly easy). You simply need to put within the consumer identify, the retainer quantity, and some different particulars and also you’re set.

Plus, one function we actually like is the “extra hours charge” function. This implies in case your consumer wants you to work above the agreed-upon variety of ours, they’ll mechanically be billed additional for the additional work. Sensible.

Be taught extra about FreshBooks’ retainer choices right here

Setting consumer retainers with QuickBooks

Whereas not fairly as easy with QuickBooks as with FreshBooks, you may as well set retainer purchasers with this Intuit device. Effectively, kindof.

You really need to create a brand new bill after which go in to customise that bill. When you’re on the customization display screen, you may edit the bill to be a part of a retainer setup, however it’s positively much less user-friendly than FreshBooks.

Be taught extra about QuickBooks’ retainer technique right here

Making use of Late Charges

One slightly efficient technique to inspire your purchasers to pay their invoices on time is so as to add a late price to the bill if not paid by its due date.

Including a late price is necessary sure, however it’s all of the extra highly effective in case your accounting software program can run it mechanically—sparing you the duty of remembering dozens of bill particulars and probably saving you from an ungainly dialog.

Setting Late Charges with FreshBooks

Freshbooks has at all times been an enormous advocate of freelancers—serving to them receives a commission on-time and pretty. And their late price possibility aligns completely with their stance.

With FreshBooks, you may mechanically set a late price to auto-generate and ship to a consumer who doesn’t pay their bill. In actual fact, it’ll simply tack the late price proper on to the prevailing bill so when your consumer lastly does get round to paying, they’ll need to pay that additional 5%, 10% or no matter you’ve set it at.

Be taught extra about FreshBooks’ late price function right here

Setting Late Charges with QuickBooks

QuickBooks, whereas they do supply this feature, has a way more handbook strategy (they declare its on your security—you wouldn’t need to ship a late price to somebody who hasn’t even seen their bill, proper?).

Inside QuickBooks, you may apply late charges to invoices that haven’t been paid, however it’s important to go into your invoices display screen manually and choose the invoices which might be late.

For sure, we predict this might be a bit extra automated.

Be taught extra about utilizing late charges with QuickBooks

Recurring Invoices

Maybe the all-time finest technique to make your service-based enterprise extra dependable, predictable, and secure is to transform one-time purchasers into recurring purchasers.

It may be simpler stated than accomplished and requires plenty of belief between you and your consumer.

But when accomplished correctly, you may set your self up for good regular progress. And sending recurring (auto-paying) invoices is a particular should if that’s the path your online business goes.

Utilizing recurring invoices with FreshBooks

FreshBooks presents the choice to transform any present bill to a recurring bill fairly simply.

Simply set the bill sort to “recurring” after which choose how typically you’d prefer it to repeat (weekly, month-to-month, and many others.). FreshBooks will then generate and ship a brand new bill each time the cycle is accomplished.

Be taught extra about setting recurring invoices with FreshBooks

Recurring invoices in QuickBooks

QuickBooks additionally presents a recurring bill possibility inside their primary bill settings. Generally they name these “Scheduled” invoices, however it’s the identical concept. Simply inform QuickBooks to ship an bill for $200 each Tuesday morning they usually’ll do it.

As an added bonus, QuickBooks may also CC you on any bill that will get despatched so there’s not just a few crazed accounting bot on the market sending recurring invoices lengthy after you imply to.

See extra particulars about QuickBooks’ recurring bill function

Monitoring Challenge Profitability

When you assume preserving monitor of the standing of a number of tasks directly could be overwhelming, attempt additionally preserving monitor of the whole variety of hours labored on a challenge and the profitability of every challenge.

It may be rather a lot to deal with—even for a mid-sized, rising firm (maybe particularly as you’re rising).

However if you wish to keep worthwhile and proceed to develop, you have to know the place every of your tasks stands.

Are you spending too many hours on it? Have your purchasers paid their invoices? Are you billing sufficient for the work you place in? Is the challenge financially underwater?

That’s the place a project-by-project monetary view turns out to be useful.

FreshBooks’ tackle challenge profitability

Sadly (perhaps as a result of FreshBooks is constructed primarily for freelancers with few staff) there’s not a very nice technique to see profitability by challenge when utilizing FreshBooks.

You’ll be able to, after all (as you may with QuickBooks) see a breakdown of bills and revenues by class (for instance, internet design), however that’s hardly the identical.

Challenge profitability studies with QuickBooks

QuickBooks, alternatively, has a much more dependable resolution for monitoring the profitability of every particular person challenge you’re employed on.

In your QuickBooks dashboard, you may get an entire monetary view of your entire tasks multi functional place. You can too simply monitor labor prices, prices of products, and different bills all associated solely to that challenge.

Be taught extra about QuickBooks’ challenge profitability options

Stock Administration

Whereas not each small enterprise has to trace stock so as to get their every day work accomplished, for people who must, it’s a critically necessary activity. In spite of everything, should you run out of stock, you run out of money circulate.

Monitoring stock utilizing FreshBooks

In all probability as a result of it was constructed primarily to service inventive people (designers, writers, and many others.), FreshBooks doesn’t have a built-in stock monitoring mechanism. If you wish to monitor stock alongside your funds with FreshBooks, you’ll need to attempt utilizing certainly one of their stock add-ons.

Monitoring stock utilizing QuickBooks

QuickBooks, alternatively, contains primary stock monitoring functionality on their hottest plan and better.

Not solely are you able to monitor your stock ranges and get alerts when stock is working low, however you may as well see prices of products, handle distributors (if in case you have them) and export all this necessary knowledge to Excel when wanted.

Be taught extra about monitoring stock with QuickBooks

Managing sub-contractors

When you plan to proceed rising your small enterprise, you’ll in all probability work with contractors. Perhaps you’ve already labored with them up to now. Otherwise you would possibly even have contractors on full-time or part-time employees indefinitely.

Both manner, your workforce of contractors may need necessary info that you simply’ll want as you handle your funds like: hours labored on a challenge; price of belongings to finish a challenge; and many others.

For that, it’s useful in case your accounting and consumer administration software program can embrace your contractors seamlessly.

Working with contractors in FreshBooks

If you rent a contractor and add them to your FreshBooks account, they’re given their very own non-public FreshBooks person account. They’ll be capable of see the tasks you invite them to and add billable hours in direction of these tasks. They will additionally course of an bill to you for the work they full.

Working with contractors in QuickBooks

In QuickBooks, you may retailer important monetary knowledge concerning the contractors you’re employed with and, come tax time, you should utilize QuickBooks to ship them their 1099 kinds (if relevant) though an additional price might apply to that state of affairs.

Managing and paying payments

Wouldn’t working a small enterprise be superb if all you ever needed to do was acquire funds?

However because the saying goes, typically it’s important to spend cash to earn money and also you’re going to inevitably have payments you’ll must pay every month.

A great accounting software program will take that into consideration and aid you pay your payments on time and from the fitting accounts.

Paying payments with FreshBooks

Regrettably, FreshBooks doesn’t supply a technique to mechanically pay your online business’ payments each month. After looking excessive and low on my dashboard and throughout Google, I simply couldn’t discover something even near what I used to be on the lookout for.

Admittedly, freelancers and solopreneurs might not have as many payments as, say, a brick-and-mortar retailer.

However actually they do have payments to pay and it could be good to do all of it from the identical place.

Paying payments with QuickBooks

QuickBooks, alternatively, integrates along with your financial institution to auto-pay necessary payments that maintain your online business shifting ahead.

It’s necessary to notice that they use an integration with Invoice to supply this service which lets you pay and monitor a wide range of distributors, contractors, and payments.

You can too sync your funds and create checks from wherever—which may turn out to be useful when your landlord nonetheless is not going to take a bank card.

Be taught extra about QuickBooks’ invoice pay options

The Winner of ‘Premium Options’

That wraps up the premium options battle and we predict it’s fairly clear we are able to really feel assured in saying the winner is:

QuickBooks — Click on right here to attempt it free for 30 days

Why QuickBooks wins this battle

Whereas each rivals had some good premium options (and once more, it is going to rely solely by yourself particular enterprise), QuickBooks snuck forward on this class as a result of it appears to be constructed extra for mid-sized companies.

Whereas FreshBooks is nice for freelancers, or groups of 1-3 folks, should you’re already a extra sizeable firm it’s possible you’ll need to go along with QuickBooks. Moreover, should you want stock administration or have a number of distributors to pay, QuickBooks will likely be a greater possibility for you proper now.

Flexibility

Except you’ve been in enterprise for many years and also you’ve obtained all of your processes nailed down and also you’re assured your online business won’t ever have to vary or adapt (Ha. Good luck!) you’re going to should be versatile.

And that signifies that your accounting software program and invoicing app must be extraordinarily versatile too.

On this part, we’ll examine which is extra versatile: FreshBooks or QuickBooks.

Progress flexibility

Maybe an important query to ask is: will this accounting software program proceed to assist me and my enterprise as I develop (scale)?

To reply this query, let’s evaluate once more the obtainable plans from FreshBooks vs QuickBooks.

FreshBooks has mainly 3 plans: Lite, Plus, and Premium. Additionally they have a Choose plan if your online business outgrows the Premium plan (over 500 billable purchasers). Every new plan supplies a better max-client quantity and new options.

QuickBooks has 5 plans: Self-Employed, Easy Begin, Necessities, Plus, and Superior. They don’t worth by the variety of purchasers, however add extra superior options with every new plan.

Up to now, they’re about even when it comes to flexibility to develop.

And that is still true until you think about QuickBooks Self-employed plan (their most entry-level plan). As unusual because it appears, it seems you may’t improve from Self-employed to every other plan.

So should you’re coming into this as a freelancer, a side-hustler, a solopreneur, or a tinkerer you’d ideally be a part of QuickBooks Self-Employed.

However then, if your online business takes off (and even grows modestly) and also you need to add a number of new options, you may’t improve instantly.

Kindof a ache.

So for that, we’re going to say Freshbooks is essentially the most versatile accounting software program on the subject of rising along with you and your online business.

Staff flexibility

Together with progress comes the necessity to carry different folks into your circle of belief on the subject of your online business funds.

Even should you don’t select to rent early on, you should still select to rent an accountant to assist evaluate your books and be sure you’re maximizing your tax deductions.

So the query is: which accounting software program appears extra versatile on the subject of including workforce members?

FreshBooks means that you can add workforce members from the get-go on their Lite plan. The one caveat: every new workforce member will price you $10/mo.

QuickBooks doesn’t assist you to add workforce members till you degree as much as their necessities plan. And whereas there’s no additional cost on that plan for a number of customers, you’re maxed out at 3.

We must always word: each instruments supply export choices to obtain spreadsheets of your knowledge and ship to an accountant.

It’s additionally necessary to do not forget that each FreshBooks and QuickBooks do have choices so as to add and/or handle contractors—which is perhaps your first set of workforce members anyway.

FreshBooks presents contractors in any respect ranges and QuickBooks presents comparable performance starting with their Easy Begin plan.

So, which is healthier on the subject of flexibility?

When you take worth out of the combo (we already hit on worth above), then FreshBooks wins this one too.

Whereas an additional $10/mo per person feels a bit steep in our opinion, it nonetheless stays extra versatile since technically we may add hundreds of customers (if cash weren’t a difficulty) even on essentially the most primary plan.

Even on QuickBooks’ most superior plan, you may solely add a max of 25 customers. And whereas it’s doubtless you received’t ever want greater than 25 folks to have entry to your books, you would possibly want that they had entry/means to bill or monitor challenge funds.

Which is extra versatile?

Ultimately, we now have to say the extra versatile account software program for a younger, hoping-to-grow enterprise is:

FreshBooks — Click on right here to attempt it free for 30 days

Connectivity

As we talked about earlier, each freelancer and small enterprise proprietor is aware of: you’ve gotten 1,000,000 issues to do.

Accounting, bookkeeping, or invoicing are simply a part of the combo.

Which implies you want a small enterprise accounting resolution that may connect with different necessary instruments in your online business.

On this part, we’ll check out FreshBooks’ vs QuickBooks’ means to connect with an important instruments your organization might have because it grows.

Variety of obtainable third celebration apps

Since no two companies are precisely alike, we are able to’t fake to know what apps you’ll hope you may join your accounting software program with.

As an alternative, let’s take a extra high-level take a look at the third-party app marketplaces:

Whereas we perceive that extra isn’t at all times higher, it’s an honest start line for an goal take a look at the connectivity skills of every software program

On the time of writing, FreshBooks has round 80 obtainable app integrations in over 25 classes. They’ve additionally added a “FreshBooks Examined” certification which we actually love because you don’t have time to be messing round with apps that simply don’t play properly collectively.

On the similar time QuickBooks boasts over 700 obtainable apps in 15 classes together with fee processing, buyer administration, payroll processing, and QuickBooks On-line backups. This is sensible attributable to QuickBooks’ market saturation and historical past within the market.

It’s attention-grabbing to level out that FreshBooks and QuickBooks even have integrations for each other. We’re not 100% positive why you would wish each instruments, however the possibility is there in any case.

High quality of third celebration apps

With out utilizing all 800+ of the apps obtainable in each of the add-on libraries, it’s arduous to essentially decide who has larger high quality app integrations.

We are going to say (and perhaps simply because there have been considerably fewer apps whole) I appeared to acknowledge way more manufacturers and instruments in FreshBooks’ market than in QuickBooks’.

Which presents extra connectivity?

Ultimately, there’s actually no contest. If you’d like an accounting software program that may connect with lots of of different instruments you is perhaps utilizing in your online business, then the apparent alternative is:

QuickBooks — Click on right here to attempt it free for 30 days

Monetary Assist

Simply because you’ve gotten entry to an incredible small enterprise accounting software program device like these doesn’t essentially imply you’ll know precisely handle your online business funds like a professional.

Which implies, one necessary consideration when selecting an accounting device is how a lot assist they can provide you when it comes to monetary data and assist.

Getting monetary assist with FreshBooks

Whereas FreshBooks does have an in depth library of documentation, most of it seems to be centered round utilizing their software program or working your small enterprise (proposales, invoices, purchasers, and many others.)

We have been unable to seek out any possibility for monetary assist from a dwell human being equivalent to an accountant or a guide.

Getting monetary assist from QuickBooks

QuickBooks, alternatively, does supply a “Dwell Bookkeeper” possibility (click on right here after which toggle the “Associate with a dwell bookkeeper” tab).

Clients who need somewhat extra skilled monetary assist can have a licensed bookkeeper units up their books via a video convention. That very same bookkeepers then supplies month-to-month studies all year long.

It’s unclear how a lot assist they offer you aside from working the studies. And this premium improve will price you a number of hundred {dollars} each month (beginning at $410/mo for QuickBooks’ most simple plan).

Who presents higher monetary assist?

If you take the hefty price ticket out of the query, the reply turns into apparent. When you’re terrified to arrange your books alone and apprehensive you received’t know course of necessary studies each month, then you need to go along with:

QuickBooks — Click on right here to attempt it free for 30 days

Technical Assist Comparability

Monetary assist isn’t the one form of aid you would possibly want when utilizing a cloud-based device like FreshBooks or QuickBooks.

Relying in your talent degree on the pc, it’s possible you’ll end up in want of technical assist when managing your books and different finance instruments (particularly at first).

Assist availability

There’s nothing extra irritating than being caught on a technical drawback with nobody that can assist you for days.

So it’s important to have good technical assist on any bookkeeping or accounting software program you select.

Assist availability with FreshBooks

When you resolve to enroll in FreshBooks, you may anticipate a workforce of technical assist employees prepared to help you.

And should you’re a fan of speaking on the telephone, you’re in luck: they’ve their assist telephone quantity listed instantly within the “assist” part.

Except for the telephone, they’ve a assist electronic mail handle with pretty fast response instances, however hey: it’s nonetheless electronic mail.

Assist availability with QuickBooks

QuickBooks takes the same strategy to customer support, however I’ve to confess: their contact info is rather a lot more durable to seek out. I feel this comes with the sheer measurement of the corporate.

With the intention to discover assist, it’s important to first inform them what software program you’re utilizing and the way, then the final class of drawback you’re having. Primarily based in your solutions you’ll be despatched to a chat module the place (hopefully) somebody may help you.

Which assist can we advocate?

Admittedly, we’ve not used the assist groups a lot for both of those merchandise.

However what we do like is the openness and transparency FreshBooks presents with their assist.

Whereas they’re lacking a chat module (is available in actually helpful should you’re in an workplace and might’t get away for a telephone name), the truth that their assist electronic mail and telephone quantity are listed instantly on the prime of their assist documentation web page means they appear to place the client very first.

We like that.

For that purpose, if technical assist is a important ingredient for you, we advise you employ:

FreshBooks — Click on right here to attempt it free for 30 days

What do actual freelancers take into consideration FreshBooks vs QuickBooks?

To wrap up this in-depth side-by-side comparability, we wished to carry a extra human ingredient to this text.

So we requested our rising group of freelancers on fb what, if any, expertise that they had evaluating these two assets. Right here’s what they needed to say:

Relies on your state of affairs…

Internet designer Cindy Rodriguez recommends QuickBooks Self-Employed should you’re at all times planning to file a Schedule C, or FreshBooks should you’re a freelancer.

“I’ve used each and favor QuickBooks Self-Employed in some methods (ACH funds are processed free of charge, mileage is mechanically calculated and it’s solely $10 a month I consider.)

You should use it so long as you may file a Schedule C which might be plenty of freelancers. QuickBooks On-line is a bit completely different and I’d advocate FreshBooks over it for freelancers.”

When you’ve got plenty of purchasers…

Freelancer Amber Richart has plenty of billable purchasers. Which is making her think about a change:

“I haven’t used QuickBooks however I’ve been contemplating going there and right here is why – the associated fee – I’m a freelancer who’s above the 50 consumer mark – however no the place close to a giant enterprise with workforce members – and due to that i’ve to pay the premium worth $50 US.

I do love FreshBooks although and I take advantage of it principally due to the time-tracking function.”

Contemplating a change…

Graphic designer Jeffrey Brown has thought of shifting to FreshBooks—primarily as a result of QuickBooks has gotten so costly.

I did the trial of FreshBooks and have been utilizing QuickBooks for over 10 years now. I see advantages to every, truthfully. Haven’t made the change to FreshBooks due to the historical past with QuickBooks, I assume. QuickBooks is dear, for what I take advantage of it for, I suppose. I’m contemplating the change, although.

Inform us what you assume:

Now it’s your flip. Be part of within the dialog(s) right here:

- Be part of our FREE freelancer mastermind group on Fb

- Click on this hyperlink so as to add your opinion to the dialog

Deciding which is healthier for you:

Ultimately, solely you know your online business state of affairs properly sufficient to decide on.

The reality is, you in all probability can’t actually go mistaken with both of them. Each have their strengths and each have their weaknesses. If neither seem to be a match, there are many QuickBooks options on the market too.

However that may be a fairly disappointing reply should you’re actually having some determination paralysis right here. So… right here’s our total advice:

Our total advice:

When you simply can’t resolve or they each seem to be a very good possibility, we advocate you begin with FreshBooks.

Why? Their workforce appears to essentially care about freelancers and small enterprise homeowners. They’ve superb rankings, all one of the best cloud-based options, and just a few drawbacks. QuickBooks out-sizes them available in the market, however FreshBooks supplies a superior expertise and can probably have essentially the most enhancements within the coming years.

And bear in mind, you may click on right here to attempt FreshBooks free for 30 days.

Extra questions folks ask about FreshBooks vs QuickBooks:

Under, we’ve collected fairly a number of questions and tried to offer our greatest reply that can assist you select.

Does FreshBooks combine with QuickBooks?

Sure. As talked about in our app integration part above, each have integrations for the opposite. We’re not sure why you’d want to attach them, however their have to be a purpose.

What’s the distinction between QuickBooks and QuickBooks Self-Employed?

As talked about in our plans and pricing part above, the most important limitation with QuickBooks Self-Employed is that you simply aren’t in a position to improve to a different QuickBooks plan should you outgrow it. So should you plan to develop, go along with QuickBooks’ Easy Begin plan or FreshBooks’ Lite plan.

What’s the best accounting software program for small enterprise?

For ease of use, we advocate FreshBooks. The onboarding is gorgeous they usually stroll you thru all the pieces in order that your online business could be up-and-running the identical day you enroll.

What’s the finest accounting software program for self-employed?

When you’re self-employed and by no means plan to rent or develop, you may safely go along with both and be positive. However should you’d like software program that may develop with you, you need to positively go along with FreshBooks.

Is QuickBooks arduous to be taught?

In comparison with FreshBooks, QuickBooks is somewhat more durable to be taught. That is in all probability attributable to the truth that it’s been round longer and software program tends to get a bit clunkier with age. In equity, although, the trendy online-only variations of QuickBooks are fairly slick.

Is there a free model of QuickBooks?

No. We’ve by no means heard of a free model of QuickBooks. You’ll be able to positively attempt QuickBooks free for 30 days by clicking right here although. When you can’t afford to pay for a service like FreshBooks or QuickBooks, there are a number of free accounting software program choices on the market.

Does FreshBooks do payroll?

No. FreshBooks doesn’t at the moment deal with payroll. However they do appear to have an excellent relationship with Gusto, a number one payroll software program which integrates fairly seamlessly with FreshBooks.

Does FreshBooks monitor mileage?

No. FreshBooks doesn’t at the moment have a local mileage monitoring function. However they do join properly with Everlance, a number one mileage monitoring service for freelancers. If you’d like an accounting software program with mileage monitoring constructed proper in, you’ll must attempt QuickBooks.

Is QuickBooks Self Employed Free?

No. There’s not a free model of QuickBooks obtainable wherever. QuickBooks Self-Employed is the most affordable possibility obtainable from QuickBooks however, as we talked about on this article, it has important limitations.

What did we pass over?

After wanting via all of this info, what did we pass over? Do you continue to have questions? In that case, simply contact us or chat with us within the Freelancer Mastermind on Fb.

We sincerely hope this analysis has helped and need you one of the best of luck.

Maintain the dialog going…

Over 10,000 of us are having every day conversations over in our free Fb group and we might like to see you there. Be part of us!

[ad_2]