Why is there inflation? Defined merely

[ad_1]

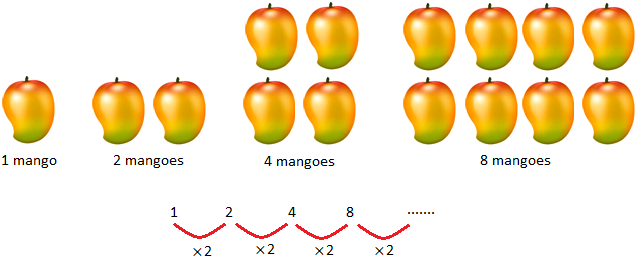

Think about that you simply wish to get a brand new guide, however it’s offered out.

There’s a very excessive demand for that guide, however not sufficient copies have been launched.

When the guide is in the marketplace once more, it prices 10% greater than earlier than it was offered out.

The guide continues to be highly regarded and customers are ready to purchase this guide even when it prices 10% extra.

The brand new value sticks and the guide is now being offered on the new, larger value.

It is a fundamental instance of how the demand-pull inflation works.

After all, the scarcity of 1 guide doesn’t trigger inflation and costs on sure objects go up and down on a regular basis. Nevertheless, when this begins occurring persistently throughout the totally different sectors for a protracted time period it means the costs usually have gone up.

In consequence, a client finally ends up paying extra for a similar quantity of services and products.

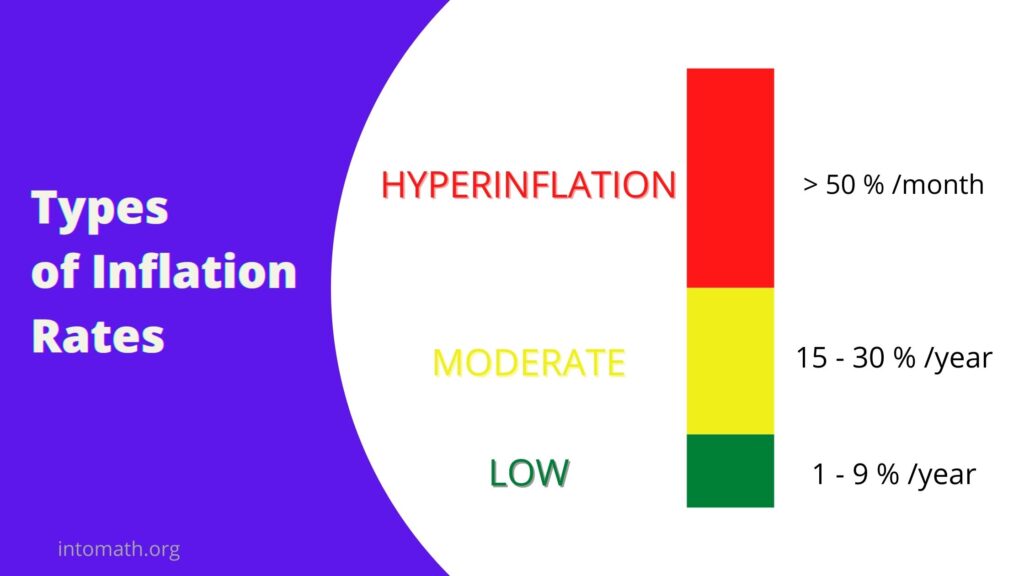

An inflation price (in %) is how a lot the costs of products or providers go up on common over a sure time period.

The annual (per yr) inflation price between 1% and three% is taken into account low.

When the inflation price hits 50% per 30 days it turns into hyperinflation.

Consider it this fashion: if a sweater prices $30 right now and the annual inflation price stays regular at round 2% every year, it will take 35 years for this sort of sweater to value double the value right now ($60).

If the inflation price is 50% per 30 days, then that very same sweater will value double in simply 1.7 months!

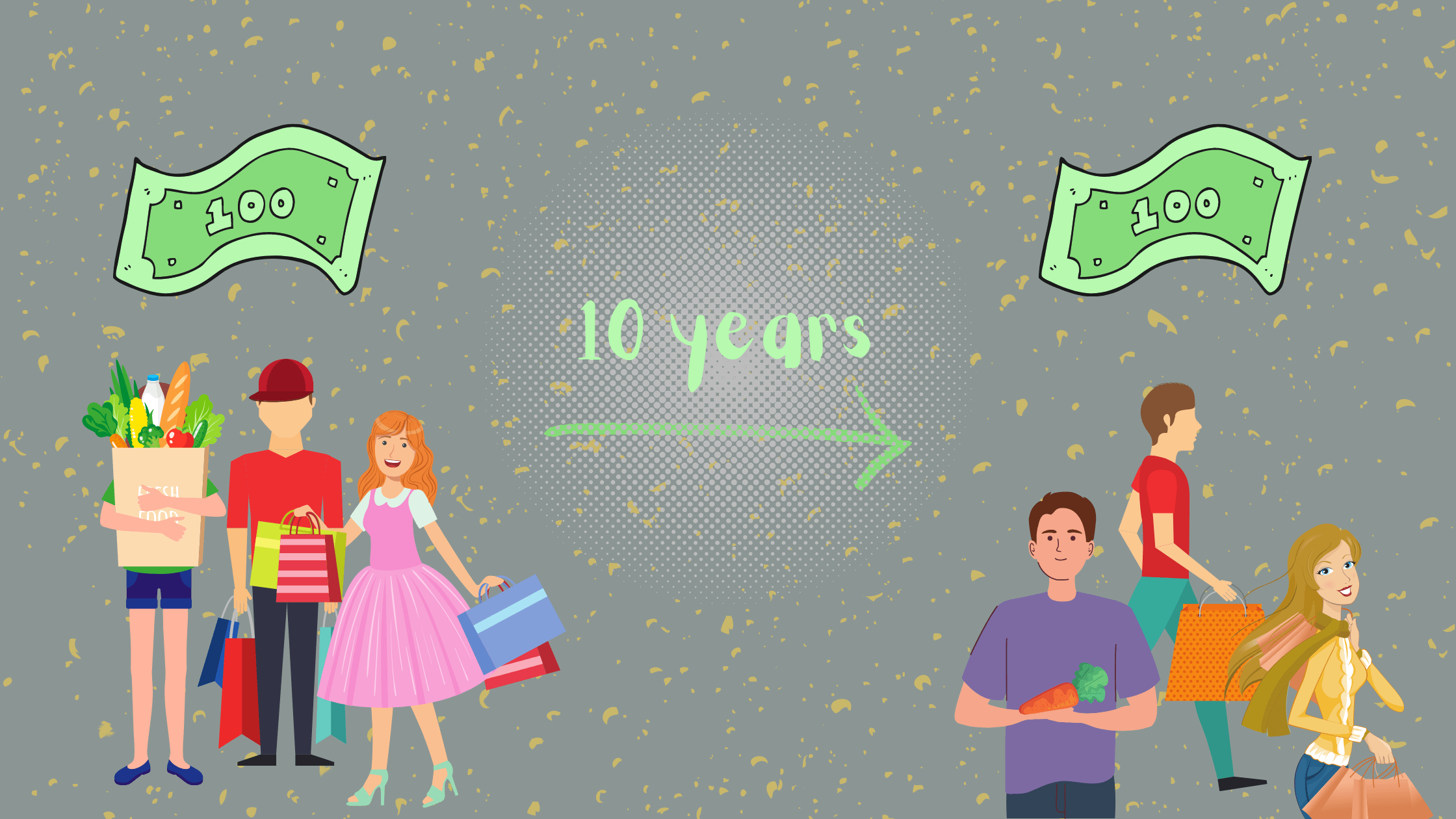

On the similar time, wages can not normally sustain with inflation.

Thus, when the annual inflation price is excessive, it’s possible you’ll be making the identical cash as you probably did earlier than the inflation hit, however now can afford much less.

Hyperinflation isn’t all the time brought on by simply the imbalance between the provision and demand in services and products. Typically it’s the results of a rise within the cash provide – when the federal government begins printing extra money. And most incessantly each elements happen on the similar time – enhance within the cash provide and enhance in demand + shortages of services and products.

The cash circulates within the economic system on a regular basis. Individuals earn cash, lower your expenses and spend cash.

Nevertheless, there are occasions when the federal government decides to print extra money than there already is in circulation. This choice might be made in response to some financial or different sort of disaster.

So why does printing extra money trigger or provides to inflation?

Think about that the sum of money you obtain as a help from the federal government along with what you’re making at your work has doubled. You’re inevitably going to spend extra. It will drive the costs up, as a result of there’s extra demand. This will even steadily devaluate the cash (an increasing number of cash should be paid for a similar factor). Hastily, what value $1 will now value $20. Subsequently, $1 is now not as precious.

All in all, a low and predictable stage of inflation means the economic system is doing effectively.

When inflation begins rising, it causes panic, extra shortages and even larger inflation.

Extra Monetary Math from IntoMath

[ad_2]